Effective risk management means depoliticizing ESG

Published date: 11 January 2023

‘Woke’ debate distracts from fiduciary duties to investors and society

The backlash in the USA against ESG (Environmental, Social and Governance), such as legal moves in the State of Texas to restrict financial institutions from using ESG investing criteria, raise questions about the relevance of sustainability data.

Yet as set out in the latest edition of The GRI Perspective, polarizing ESG into left-wing ‘woke’ versus conservative ‘anti-woke’ terms is counter-productive. When a balanced viewpoint is taken, it’s clear that ESG considerations are a key aspect of how asset managers fulfil their fiduciary duties towards investors and other stakeholders:

Taking the ‘anti-woke’ debate seriously: Why business risk and ESG accountability go hand-in-hand

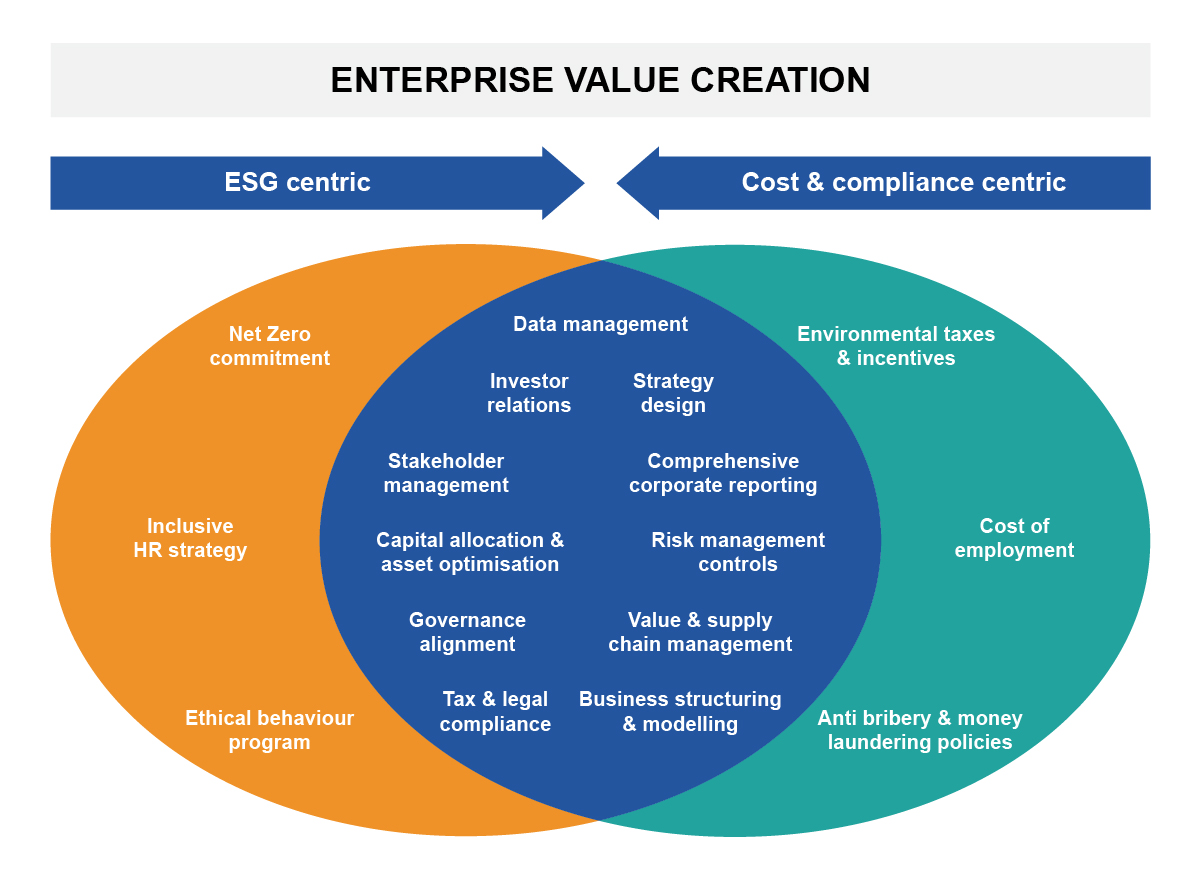

ESG can have significant value enhancing or destructive effects on a business, such as those related to climate or social equality, requiring investors to understand the opportunities and trade-offs involved. Regardless of whether risks stem from non-ESG or ESG related topics, this means they need to be disclosed, understood and managed.

Eelco van der Enden, CEO of GRI said:

“While there can be ideological disagreements over ESG, if we listen to both sides and stick to the facts then common ground can be found. Instead of focussing on what is ‘woke capitalism’ or not, we need a rational discussion on what is good business practice. And the simple truth is that sustainability and effective risk management are completely aligned.

Responsible stewardship means taking care of the fiduciary duty towards stakeholders, society and the environment. In the long-term, you cannot run a successful company in a dysfunctionality society, or a failing planet.

Proportionality in decision making is key. Often it is not ESG that politicizes business, but politicians who politicize ESG.”

The GRI Perspective is a regular briefing series, launched in January 2022, covering topical themes from the world of sustainability reporting. Focus areas in previous issues include human rights reporting, stakeholder capitalism, lobbying, tax transparency – and more.

As confirmed by new research from KPMG, across all regions GRI provides the world’s most widely used sustainability reporting standards, including by 78% of the world’s largest 250 companies.